Streamline Your Funds With Cooperative Credit Union Solutions

Discovering just how cooperative credit union options can streamline your financial journey reveals a realm of benefits that prolong beyond conventional financial services - credit union cheyenne wy. Think of a monetary partner that not only provides customized attention however likewise promotes a sense of area possession, all while using far better rate of interest on financial savings accounts. This special method to banking offers an engaging case for those looking for a much more tailored and empowering financial experience

Advantages of Cooperative Credit Union Subscription

Credit rating Union subscription provides a multitude of benefits that cater to the economic demands of individuals looking for trustworthy and member-focused banking solutions. Additionally, Debt Unions normally offer a large range of monetary items and services, including checking and financial savings accounts, financings, credit report cards, and investment choices.

Personalized Financial Assistance

Unlike typical banks, credit score unions focus on participant contentment over earnings, offering a more tailored approach to economic services. When you join a credit score union, you obtain accessibility to financial consultants who take the time to understand your unique situation and provide customized referrals to help you achieve your economic purposes.

Customized economic assistance from cooperative credit union can incorporate a wide variety of services, including producing an individualized budget, setting financial goals, preparing for major life events such as purchasing a home or conserving for retired life, and optimizing your investments. Whether you are just starting your financial journey or wanting to enhance your current monetary method, cooperative credit union experts can use beneficial understandings and recommendations to assist you navigate your financial path effectively.

Streamlined Electronic Banking Provider

Successfully handling your financial resources has ended up being much more convenient many thanks to the structured electronic banking services provided by credit rating unions. These services offer participants with very easy access to their accounts 24/7, allowing them to inspect balances, transfer funds, pay expenses, and also established automated repayments from the convenience of their own homes. With protected online systems, debt unions make certain that participants' financial info is shielded while providing user-friendly discover here user interfaces that simplify the financial experience.

In addition, numerous cooperative credit union use mobile financial apps that allow participants to perform numerous financial activities on their mobile phones or tablets. This versatility allows participants to remain on top of their financial resources while on the go, making it simpler to monitor purchases and handle their cash effectively. Through electronic banking solutions, cooperative credit union are able to improve the general client experience by supplying convenient devices that equip members to take control of check this their monetary wellness.

Low-Interest Funding Options

To even more sustain their participants' financial health, lending institution use low-interest car loan options that supply easily accessible financing for numerous needs - credit union cheyenne wy. These lendings commonly feature reduced rate of interest prices contrasted to standard financial institutions, making them an appealing choice for participants seeking to obtain money while lessening rate of interest expenses

Cooperative credit union provide a variety of low-interest funding alternatives, including personal fundings, automobile finances, home equity lendings, and credit scores building contractor fundings. Personal finances can be used for different functions such as debt consolidation, home improvements, or unanticipated expenditures. Car car loans help participants fund a new or previously owned lorry at a reduced rates of interest, potentially conserving them money over the life of the loan. Home equity financings enable property owners to obtain against the equity in their homes for big expenditures like home remodellings or clinical bills. Credit report builder financings are developed to aid members establish or enhance their credit report rating by making normal payments on a little lending amount.

Budgeting Devices for Financial Success

Consider implementing a comprehensive set of budgeting tools to boost your financial success and achieve your long-term financial goals effectively. Budgeting is an essential aspect of economic administration, enabling you to track your revenue, expenditures, and cost savings successfully. By using budgeting tools, such as on-line spending plan calculators, cost tracking applications, and even basic spreadsheets, you can gain insight into your investing behaviors, determine areas where you can cut down, and allot funds in the direction of your economic priorities.

Additionally, look at here automated budgeting devices offered by credit rating unions can aid you set monetary objectives, track your development, and receive signals for upcoming bills or low equilibriums. By incorporating these budgeting tools right into your financial preparation, you can take control of your cash and pave the way for long-lasting economic success.

Conclusion

In verdict, credit report union options offer benefits such as personalized monetary guidance, structured online financial solutions, low-interest finance choices, and budgeting tools for monetary success. By streamlining your financial resources via a cooperative credit union membership, you can access customized monetary help, affordable rate of interest, and a dedication to monetary education and learning and empowerment. With these sources, participants can make educated cash monitoring choices, established economic objectives, and attain overall financial well-being.

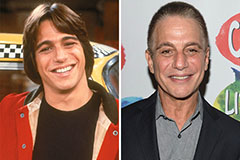

Tony Danza Then & Now!

Tony Danza Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!